Is your content making you income?

The ATO has warned content creators that they need to be aware of their income tax and GST obligations.

Tip: Examples of content creators are individuals who write a blog, post make-up tutorials to social media or stream gaming or other activities for others to watch.

If you start making money from your online content, you will have income to declare. You will also need to consider whether you are in business. If you are, or you want to start your own business, it’s important you know what income you need to report, the deductions you can claim and what registrations you may need.

The income you receive could be cash, money for advertising or appearance fees, or goods like a gaming console, clothes or make-up.

It doesn’t matter whether the income comes from Australia or overseas. It is all taxable in Australia, as long as you are considered to be a tax resident of Australia.

Some of your supporters may purchase your merchandise or pay a subscription fee to access your content. They may send tips or gratuities (often called gifts). All of these are likely to be income and should be declared.

There are some important things to think about if you’re a content creator. Can you afford to accept the gifts? A new handbag or a free holiday may be enticing, but because it’s regarded as income, you’ll need to pay tax on it.

Consider how the income you earn will affect your other amounts payable. Sole trader income counts towards your total assessable income, so it could impact your study loans or Medicare calculation.

If you’re in business, and you have a GST turnover of $75,000 or more, you’ll need to register for GST. You will be liable to pay GST on your taxable supplies, even if you don’t pass it on to your supporters. However, you can claim input tax credits on what are called “creditable acquisitions”.

You will be able to claim deductions for business-related expenses. You may also be eligible for various small business concessions.

Home charging rate guideline for EVs released

With the increasing popularity and uptake of electric vehicles (EVs), the ATO has now released a draft compliance guideline which contains the methodology for calculating the cost of electricity when an eligible electric vehicle is charged at an employee’s or an individual’s home. The methodology can be applied for FBT from 1 April 2022 and for income tax purposes from 1 July 2022.

According to the ATO, the EV home charging rate will be 4.20 cents per kilometre. If charging costs are incurred at a commercial charging station, a choice must be made: if the EV home charging rate is used, the commercial charging station cost will be disregarded, and vice versa. However, records such as receipts must still be kept to substantiate any claims, and the choice to rely on the guideline applies for the entire FBT or income year.

For the 2023 FBT and income tax year, the ATO will accept a reasonable estimate based on service records, logbooks, or other available information where odometer records have not been maintained as a transitional measure. This approach is only available for the opening odometer reading at 1 April or 1 July 2022.

Businesses that can rely on this guideline include those that provide electric vehicles to their employees (or associates) for private use, where that results in the provision of a car fringe benefit, residual benefit or car expense payment fringe benefit and the business is required to calculate the value of benefit as a part of FBT obligations. For example, the EV home charging rate can be used to determine the recipient contribution component for the statutory formula method for car fringe benefits. Similarly, it can be used to determine both the operating cost and recipient contribution if the operating cost method is used.

For individuals, the guideline can only be relied on to calculate the cost of charging an electric vehicle if a zero emissions electric vehicle was used in carrying out income-earning activities and relevant records have been kept during the year.

Tip: Plug-in hybrids (vehicles powered by a combination of liquid fuel and electricity) aren’t considered zero emission vehicles, so if you use one you can’t rely on the guideline even if the vehicle is used in income-earning activities.

The guideline is currently in draft form but is expected to apply to the 2023 FBT and income tax year.

Property investors beware: new data matching program

Individual property investors should be aware that the ATO has announced a new data matching program that will obtain data from various financial institutions for the 2021–2022 to 2025–2026 income years. Records relating to approximately 1.7 million individuals will be obtained each financial year and used to identify relevant cases for administrative action, including compliance activities and education strategies.

Recent results of sample audits across individuals conducted under the ATO’s random enquiry program appeared to show a net tax gap of $9 billion for the 2020 income year, with the incorrect reporting of rental property income and expenses being a significant driver of the gap. Specifically, the estimated net tax gap for rental property expenses contributed around $1 billion or 14% of the total individuals gap, with a common driver being the incorrect apportioning of loan interest costs where the loan was refinanced or redrawn for private purposes.

The data providers for the new program include the big four banks (ANZ, Commonwealth, Westpac and NAB), as well as other providers and their subsidiaries, including Adelaide Bank, Bank of Queensland, Bendigo Bank, Bankwest, ING, Macquarie Bank, Suncorp, RAMS, Ubank, St George, Bank of South Australia, Bank of Melbourne and ME Bank. The ATO will be the matching agency and the sole user of the data.

According to the ATO, after a return is lodged, it will use the data collected to identify relevant cases for administrative action including compliance activities and education strategies. If a discrepancy is identified, taxpayers will be contacted by phone, letter or email, and will then have 28 days to respond.

The ATO will also use the data to gain insights to help develop and implement treatment strategies to improve voluntary compliance. The data may also be made available to individual self-preparers through myTax, specifically the rental property schedule interest on loans and/or borrowing expense labels and rental income tax return labels.

Super tax concession changes: consultation

As flagged earlier in the year when the announcement was made, the Federal Government recently released a consultation paper on its proposal to reduce super tax concessions for individuals with super balances over $3 million, including those with self managed super funds (SMSFs). Some important questions the paper asked included whether the proposal would create any unintended consequences and whether the current proposed proportioning methods are appropriate. The new measure is not yet law.

To recap, the government proposed in late February that individuals with a total super balance (TSB) of more than $3 million combined in all the super accounts will have their super concessional tax rate changed to 30% from the 2025–2026 financial year onwards. This means from 30 June 2026, the earnings of those individuals on the part of their TSB over $3 million will attract an additional 15% tax. The additional tax will be applied directly to the individual and there will be no change to the tax arrangements within super funds.

The ATO will continue to calculate the TSB of all individuals annually using existing information provided by super funds and SMSFs. Individuals will be able to quickly identify whether they will be subject to the new tax by reference to their TSB at the end of each financial year through myGov. As it is proposed, the threshold will not be indexed and is not shared between spouses, family members or between other individuals who have interests in the same fund such as an SMSF.

The additional 15% tax will be determined by the ATO and levied directly on individuals. This will also be imposed separately to personal income tax, and it is intended that the amount of tax payable would not be reduceable by deductions, offsets or losses available under the personal income tax system (ie only prior year negative earnings could be applied).

Superannuation and independent contractors: fresh Full Federal Court guidance

In February 2022, the High Court handed down a landmark decision in ZG Operations v Jamsek, which clarified the test for determining whether a worker is an employee or an independent contractor.

The High Court remitted the question of whether the workers were “employees” under the extended definition of that term in s 12(3) of the Superannuation Guarantee (Administration) Act 1992 (the SGA Act) back to the Full Federal Court.

In deciding that the relevant workers were not “employees” under the extended definition in s 12(3), the Full Federal Court determined that s 12(3) does not apply to an independent contractor relationship where the worker uses a company, trust or other service vehicle to contract with the putative employer instead of doing so in their personal capacity. This confirms the ATO’s guidance in Superannuation Guarantee Ruling SGR 2005/1.

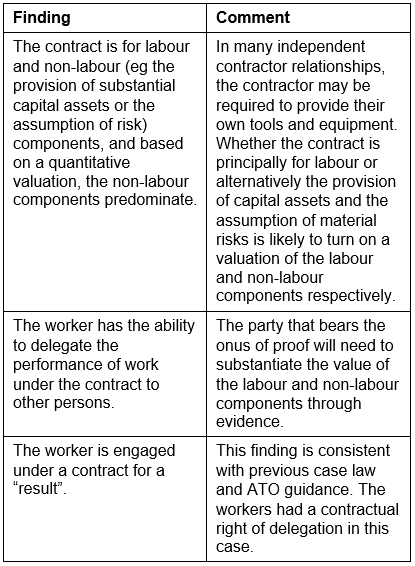

Additionally, in determining whether a worker is an “employee” under the extended definition in s 12(3), the Full Federal Court has confirmed that a worker will not be taken to work under a contract that is “wholly or principally for [their] labour” in the following circumstances.

Employers are required to provide their employees with a minimum level of superannuation support (currently 10.5%) each quarter, otherwise the employer will become liable to pay the superannuation guarantee charge. An “employee” for these purposes includes an employee at common law.

The SGA Act also includes a number of provisions which extend the meaning of “employee”. Relevantly, s 12(3) of the SGA extends the meaning of “employee”, so that: “If a person works under a contract that is wholly or principally for the labour of the person, the person is an employee of the other party to the contract.”

This provision is broad and captures many independent contractor relationships. An entity that engages an independent contractor under a contract of this nature is required to provide the contractor with superannuation support (otherwise they will become liable to pay the superannuation guarantee charge).